Kumar said the threshold for the 30% tax rate to kick in could be enhanced from Rs 15 lakh to Rs 25 lakh for the new regime.

The government is considering a proposal to reduce the mandatory lock-in period for tax-saving fixed deposits in banks from the current five years to three years to make them more attractive to customers in a low-interest rate regime, sources told FE. This will likely feature in the Budget for 2022-23, which will be presented on February 1.

It is also weighing the option of making the tax slabs under the regime without exemptions more graded to make it more attractive to taxpayers under different brackets, especially those with lower incomes. The review of the regime, introduced as an option for taxpayers last year along with the conventional one that allows various exemptions but with relatively higher rates, is necessitated by the lukewarm response of the taxpayers to the new regime. One option is to make available standard deduction to those who opt for the regime sans exemptions.

Also, there is a feeling among tax experts that the new optional regime hasn’t really served the stated purpose of simplifying the tax system. However, a final decision on this is yet to be taken, according to sources familiar with the matter.

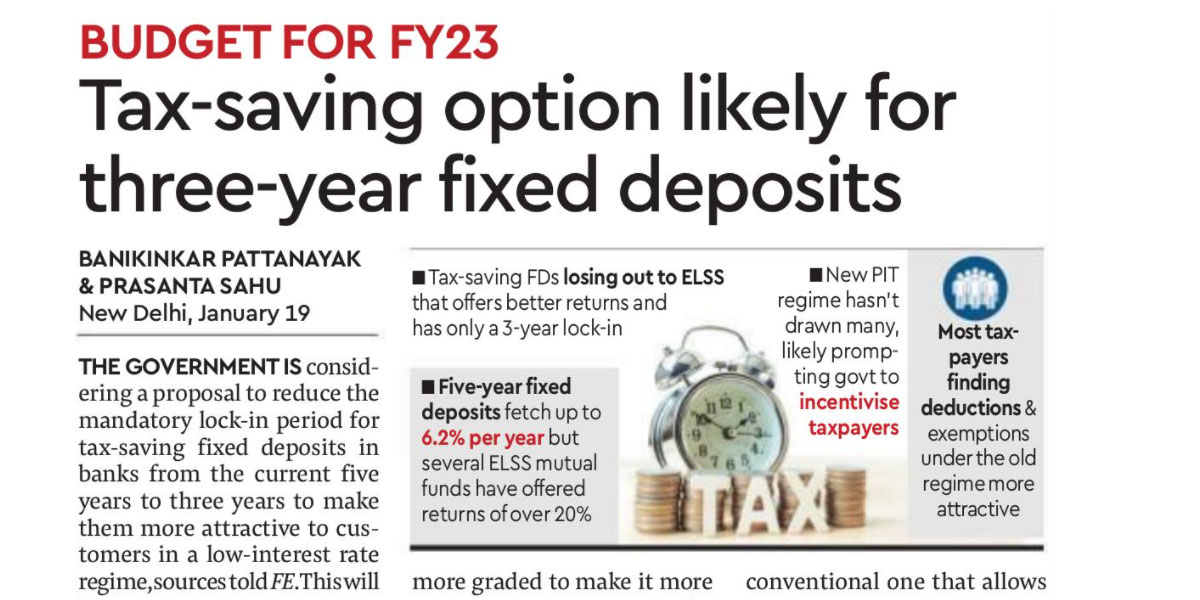

The proposal to reduce the lock-in period for tax-saving fixed deposits comes amid fears that such deposits are losing sheen due to better returns, coupled with tax incentives, provided by equity-linked saving schemes (ELSS) that have a lower lock-in period of three years. People are allowed to claim deductions of up to Rs 1,50,000 under Section 80C of the Income Tax Act if they invest in tax-saving fixed deposits of banks as well as ELSS mutual funds.

However, while most banks are offering annual interest of up to 6.2% (the highest rate is for senior citizens) on a five-year tax-saving fixed deposit, several ELSS mutual funds have fetched annual returns in excess of 20%. Importantly, the three-year lock-in, currently offered by ELSS funds, is the shortest among all 80C options.

An analysis done by tax software platform Clear showed that less than 10% of the taxpayers who filed tax returns for assessment year 2021-22 through them opted for the new regime, its CEO Archit Gupta told FE.

“Some of the deductions such as standard deduction, deduction for HRA, LTA, housing interest should be allowed under the new tax regime as one ends up spending/investing on these items as a matter of routine living,” said Kuldip Kumar, Partner, Price Waterhouse & Co LLP.

The exemptions-free regime offers lower tax rates in a graded manner, that is, 5% rate for income of Rs 2.5-5 lakh, 10% for Rs 5-7.5 lakh, 15% Rs 7.5-10 lakh, 20% Rs 10-12.5 lakh, 25% to 12.5-15 lakh and 30% for over Rs 15 lakh. Analysts say too many slabs also may have confused people.

“The government may have to find a mid-way, say, by changing the slabs and allowing taxpayers to claim some deductions,” said Amarpal Chadha, tax partner and India mobility leader, EY. Chadha suggested 15% tax for Rs 5-10 lakh income slab and 25% for Rs 10-15 lakh under the new regime.

Kumar said the threshold for the 30% tax rate to kick in could be enhanced from Rs 15 lakh to Rs 25 lakh for the new regime.

“Given that people have overwhelmingly opted for the old regime, it makes a lot of sense to review the new regime after analysing the returns for the first year (assessment year 2021-22) if the government wants to continue with two regimes,” Clear CEO Gupta added. In the current form, the new regime may be beneficial for the first-time employees who may not save much in the initial years of their career.

Under the older regime, Section 80C provides for deductions for investments made in PPF, EPF, LIC premium, equity linked saving schemes, principal amount payment towards home loan, stamp duty and registration charges for purchase of property, Sukanya Smriddhi Yojana, national saving certificate, senior citizen savings scheme, ULIP, infrastructure bonds, etc besides tax-saving FD for five years. Also, under Section 80CCD, additional deduction of Rs 50,000 is allowed for amount deposited to the National Pension System account. Standard deduction of Rs 50,000 is also available for taxpayers under the old regime.